529 Limits 2024 Senate. When considering 529 contribution limits, remember the annual gift tax exclusion. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

As of 2024, up to. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

529 Limits 2024 Senate Images References :

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2024 Aggy Lonnie, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

529 Plan Contribution Limits For 2023 And 2024, 2024 has brought new rules for 529 college savings accounts, including the ability to roll over funds to a roth ira without taxes or penalties.

Source: eadabelianora.pages.dev

Source: eadabelianora.pages.dev

529 Plan Limits 2024 Texas Shane Darlleen, What’s the contribution limit for 529 plans in 2024?

Source: elsieqgianina.pages.dev

Source: elsieqgianina.pages.dev

Iowa 529 Contribution Limit 2024 Zora Annabel, What’s the contribution limit for 529 plans in 2024?

Maximum 529 Plan Contribution 2024 Jade Rianon, Review how much you can save for college in these plans.

Source: aubryykalinda.pages.dev

Source: aubryykalinda.pages.dev

529 Plan Contribution Limits 2024 Colorado Lissa Phillis, In 2024, individuals can gift up to $18,000 in a single 529 plan without those funds counting against the lifetime gift tax exemption amount.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, The irs views contributions to 529 plans as gifts.

Source: abbybodelle.pages.dev

Source: abbybodelle.pages.dev

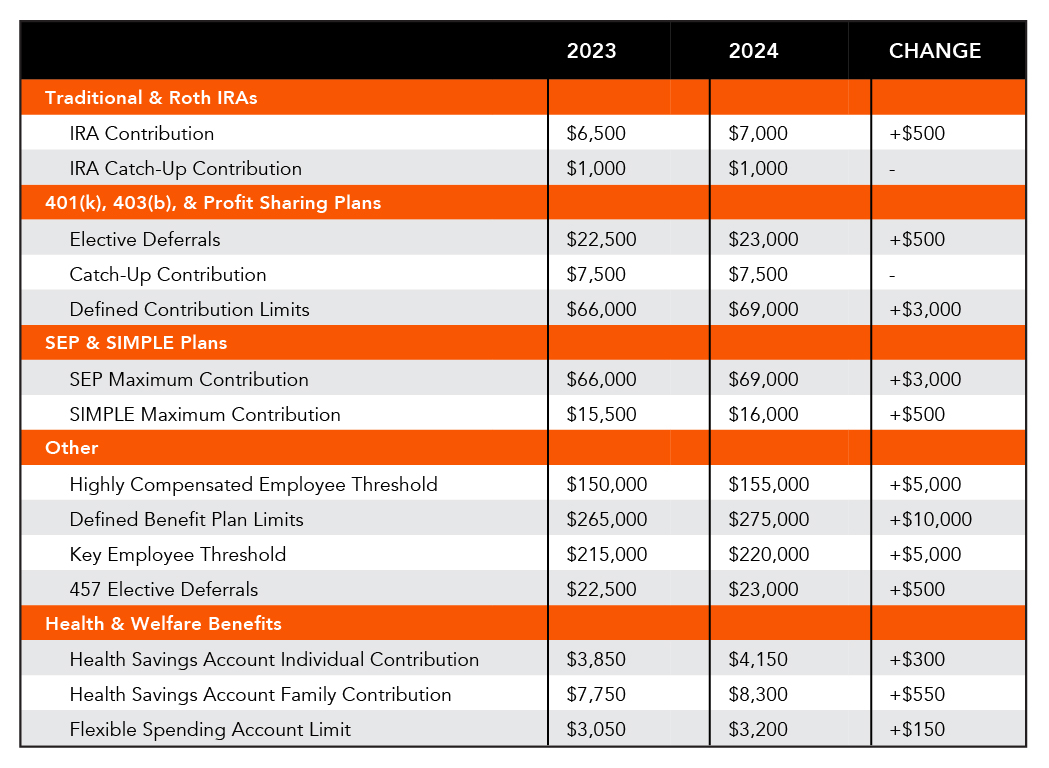

Irs Announces 2024 Hsa Limits Glenna Feodora, In 2024, you can give up to $18,000 per.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2024 Retirement & Employee Benefit Plan Limits, One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

Posted in 2024